Category: Holdings

-

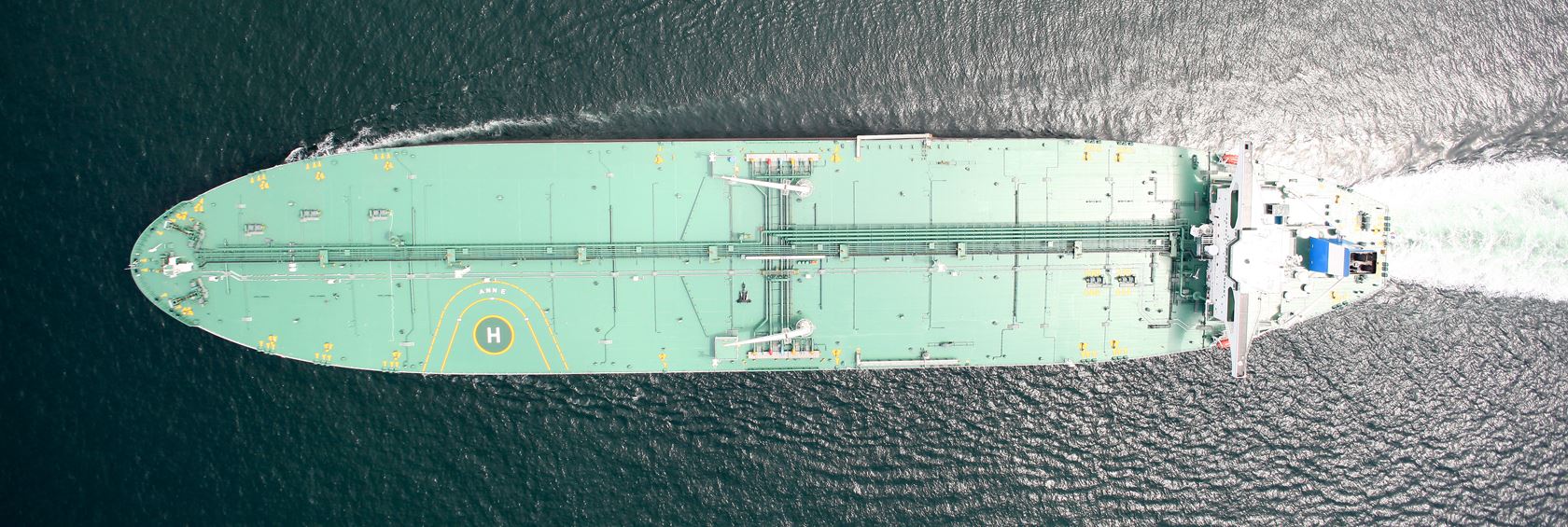

Teekay Tankers ltd

Teekay Tankers Ltd. provides crude oil and other marine transportation services to oil industries.

-

Dorian LPG LTD

Dorian LPG Ltd. is a leading owner and operator of modern very large gas carriers (VLGCs), specializing in the transportation of liquefied petroleum gas (LPG).

-

EURONAV NV

Euronav NV (EURN), together with its subsidiaries, engages in the transportation and storage of crude oil worldwide.

-

Tenaris SA

Tenaris SA manufactures and supplies steel pipe products.

-

CVR Energy inc.

CVR Energy Inc. is a diversified holding company involved in petroleum refining and nitrogen fertilizer manufacturing.

-

Petróleo Brasileiro S.A.

Petróleo Brasileiro S.A. (“Petrobras”), a state-owned Brazilian oil and gas giant.

-

Scorpio Tankers Inc.

Scorpio Tankers Inc. is a leading provider of marine transportation for petroleum products, operating a fleet of 110 tankers.